SoftBank recently announced a significant turnaround in its Vision Fund, posting a gain of 724.3 billion Japanese yen ($4.6 billion) in the fiscal year ended March. This marks the first time since 2021 that the flagship tech investment arm has been in the black. The Vision Fund segment recorded a profit of 128.2 billion yen for the full fiscal year, rebounding from a 4.3 trillion yen loss the previous year. This recovery in the Vision Fund contributed to SoftBank Group’s overall profitability in the fiscal fourth quarter that ended in March.

The positive performance of the Vision Fund can be attributed to the increase in the value of key investments such as ByteDance and DoorDash. However, not all investments fared well, as losses were incurred from investments in companies like DiDi and WeWork. The IPO of chip designer Arm played a significant role in driving the gains for the Vision Fund. It is worth noting that gains associated with the Arm IPO were not reported in SoftBank’s consolidated statement of profit or loss.

Despite the improvements in the Vision Fund, there are still challenges ahead for SoftBank. The company faced losses in some tech firms and experienced market volatility. However, signs of recovery are evident as SoftBank surpassed market estimates in terms of net sales and net profit for the March quarter. While an overall loss of 227.6 billion yen was reported for the full year, it is a significant improvement compared to the previous fiscal year’s loss of 970.1 billion yen.

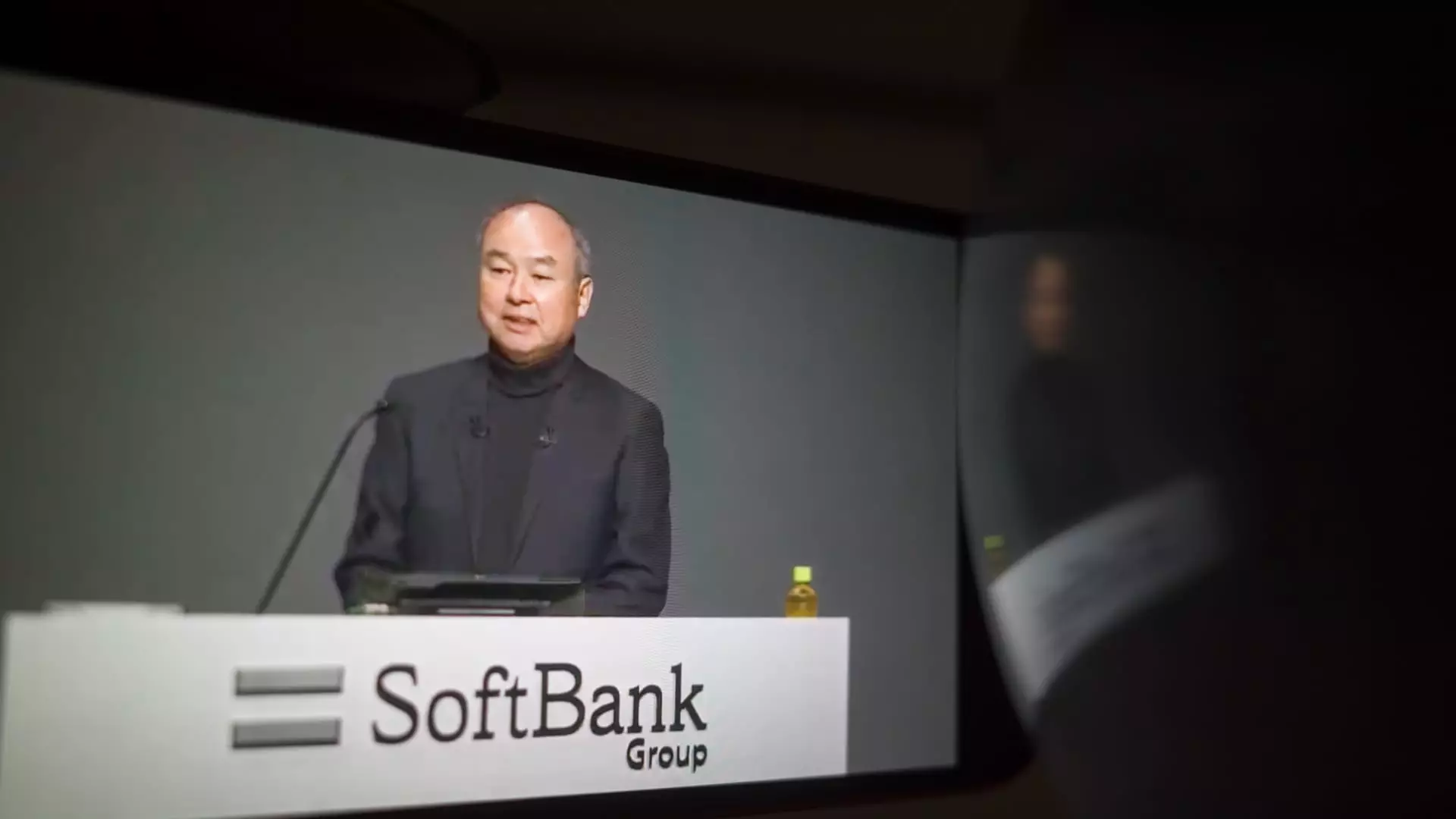

SoftBank’s founder, Masayoshi Son, signaled a shift in strategy towards a more proactive approach in 2023, moving from defense to offense. The company is focusing on building an AI-centric portfolio and making new investments in the technology sector. The emphasis on artificial intelligence technology is highlighted by the increasing significance of Arm within SoftBank’s portfolio. Arm accounted for 47% of assets held by SoftBank at the end of March, showcasing the company’s commitment to AI technology.

As SoftBank navigates its path to recovery, it is essential to monitor the progress of the Vision Fund and the impact of strategic shifts in the company’s investment approach. The focus on AI technology presents new opportunities for growth and diversification. While challenges persist in the ever-changing tech landscape, SoftBank’s resilience and strategic vision position it for future success in the tech investment sector.

Leave a Reply