In an evolving landscape of innovation and entrepreneurship, the United States continues to be a nurturing ground for unicorns—startups valued at $1 billion or more. According to insights from the PitchBook/NVCA Venture Monitor for Q4 of 2024, a significant number of these companies are anticipated to pursue an Initial Public Offering (IPO) in 2025. This swell in optimism stems from various indicators within the venture capital ecosystem, which insights suggest could signal a recovery in the market and provide fertile ground for future public offerings.

PitchBook has developed an effective tool—the VC exit predictor—which utilizes advanced machine learning algorithms and a comprehensive database to furnish a probabilistic forecast of a startup’s exit strategy. Startups are rigorously analyzed and assigned a percentage indicating their likelihood of being acquired, going public, failing, or achieving self-sustainability. This rigorous analysis not only enriches investors’ insights but possibly influences strategic decision-making for startup founders aiming towards growth and exit strategies.

Despite the hopeful projections, the landscape is riddled with challenges. The absence of substantial exits over recent years underscores a mismatch in valuations between buyers and sellers. Startups that once enjoyed inflated valuations are grappling with introspective reevaluations as the market prepares for a recalibration. Furthermore, the regulatory environment has imposed barriers that dampen the enthusiasm for M&A activities, stymying what would typically be an active exit pipeline.

Nizar Tarhuni, EVP of research and market intelligence at PitchBook, expressed a cautiously optimistic outlook for 2025. He articulated that a favorable shift in the political landscape and an improvement in the collective expectations of startups and investors regarding valuations could act as catalysts for bringing more capital into play. The present situation demands patience, as the market slowly navigates toward a potential resurgence amid prevailing challenges.

Echoing this cautious optimism, Bobby Franklin, CEO of the NVCA, emphasized a renewed sense of hope in the venture capital space. He indicated that recent leadership changes at the Federal Trade Commission (FTC) and the Department of Justice (DOJ) could alleviate liquidity concerns for portfolio companies. Moreover, shifts at the Securities and Exchange Commission (SEC) may reduce burdensome regulations—factors critical for revitalizing investor confidence.

Among the multitude of U.S. tech unicorns poised for the public markets in 2025, a few prominent players stand out for their high IPO probability. Leading the list is Anduril, an aerospace and defense startup founded by Oculus co-founder Palmer Luckey, boasting a staggering 97% chance of going public. Another frontrunner, Mythical Games, a Web3 gaming company led by John Linden, shares the same likelihood, portraying a robust intersection of technology and entertainment. Other notable contenders include Ayar Labs, Carbon, Databricks, and StockX, each with promising forecasts that suggest a vibrant upcoming year for tech-related IPOs.

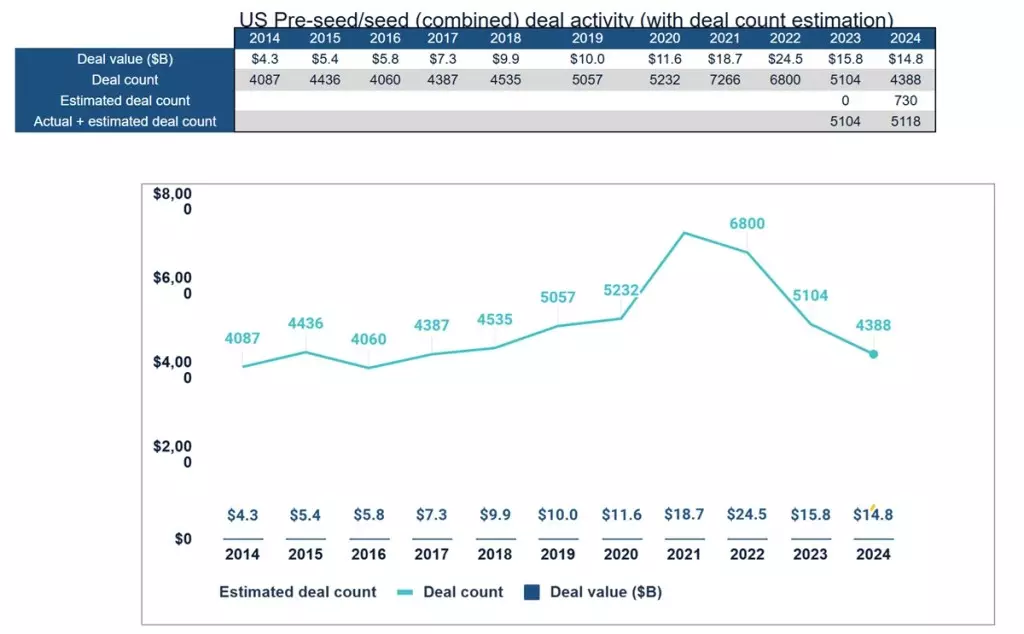

In contrast, the systematic decline in early-stage funding raises critical questions about the longevity of the venture capital ecosystem. The largest category of deal count in 2024 fell between $1 million and $5 million, highlighting a retreat from the exuberant investments seen in prior years. This drop signifies a cautious approach among investors, who are now more discerning about where they allocate their funds.

The interim state of the venture capital landscape, marked by a sense of recalibration, presents both challenges and opportunities. The anticipated tax reforms coursing through Congress may provide the much-needed impetus for innovation as they hold the potential to reintroduce favorable conditions for R&D activities. The evolving regulatory climate will likely play a critical role in defining the trajectory for many startups looking towards the public markets.

As the unicorns prepare their bids for public attention in 2025, both founders and investors remain keenly aware that the road ahead may require adapting to a new normal. The quest for sustainable growth against a backdrop of heightened scrutiny and regulatory evolution will continue to shape the dialogue within the venture capital community. With a mixture of renewed hope and strategic caution, the entrepreneurial spirit in the U.S. may find its way to not just stay afloat but thrive amid the challenges that lie ahead.

Leave a Reply