As Nvidia prepares to announce its fourth-quarter earnings, anticipation in the financial world is palpable. The earnings report, expected to shed light on Nvidia’s performance for the quarter ending in January, comes at a pivotal time for the tech giant. Analysts predict an adjusted earnings per share of $0.84 and revenue soaring to approximately $38.04 billion, marking a staggering 72% year-over-year growth. This impressive spike underscores the remarkable trajectory of Nvidia, a company that has soared to new heights in the tech industry, primarily due to its dominance in the artificial intelligence (AI) landscape.

Nvidia’s success is emblematic of a larger narrative surrounding AI technologies. With a forecast that suggests total revenue for the fiscal year could exceed $130 billion—more than double from the previous period—the company has become a linchpin in AI operations. Its data center graphics processing units (GPUs) are integral for developing AI applications, making Nvidia a central player in the AI revolution, particularly with products like OpenAI’s ChatGPT.

The company’s stock price reflects this success, surging more than 440% over the past two years and at one point reaching a staggering market capitalization exceeding $3 trillion. Such numbers paint a picture of a soaring titan, but with great success comes the inevitable question: can Nvidia maintain this growth trajectory?

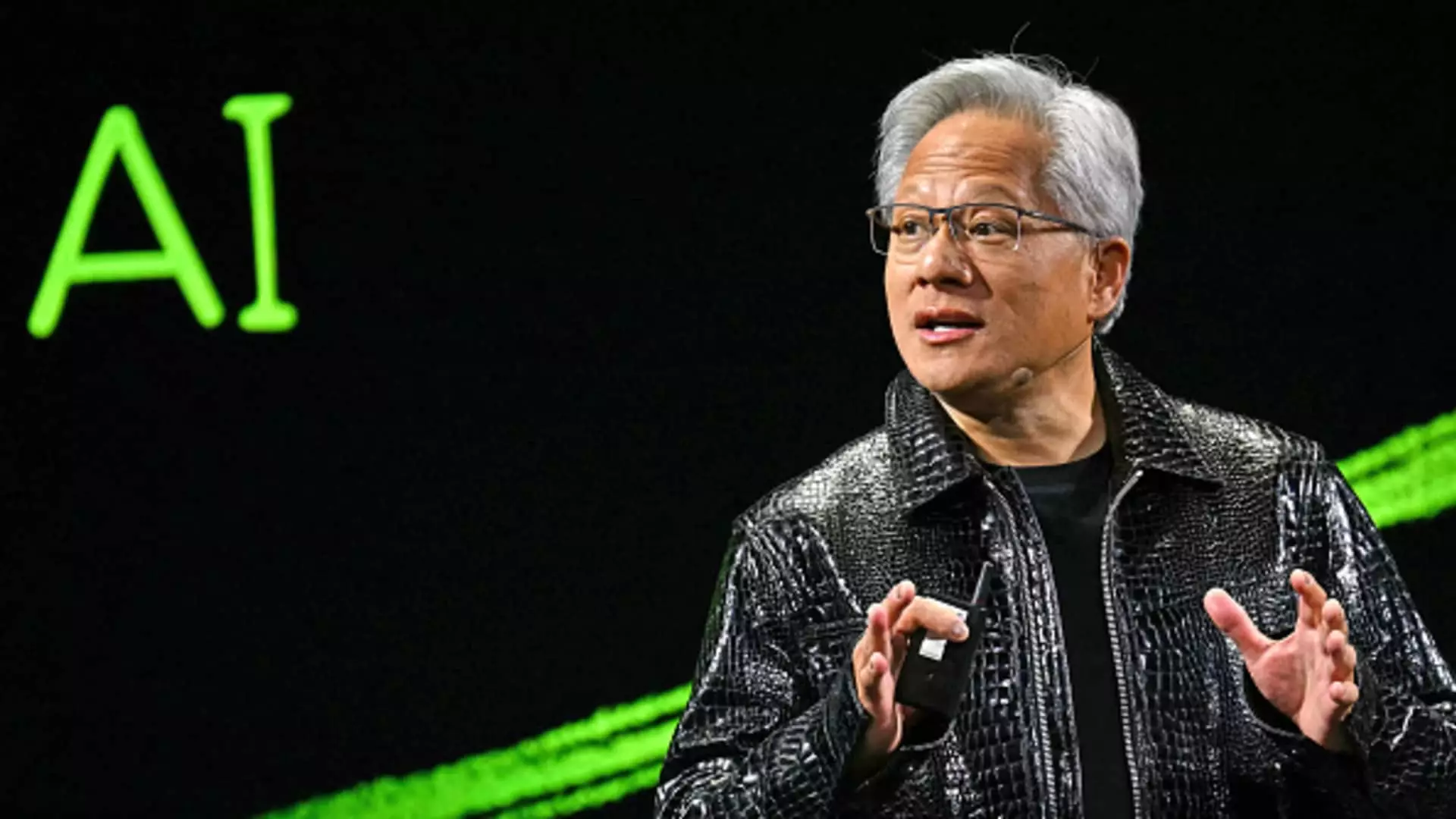

Recent months have seen a shift in Nvidia’s stock performance that might provoke investor anxiety. The stock’s current price mirrors that of last October, raising concerns about potential stagnation. Investors now face critical questions regarding the company’s future. Will Nvidia continue its upward ascent, or will emerging challenges stifle its growth? The responses to these concerns will be crucial, especially as Nvidia CEO Jensen Huang prepares to navigate these complex dynamics during the earnings call.

One area of concern revolves around the company’s core customers—hyperscale cloud companies—that have driven Nvidia’s sales. After years of robust capital expenditures, there are palpable worries that these companies might be reassessing their spending habits. The recent emergence of DeepSeek, a Chinese AI model, poses a direct challenge to Nvidia’s market assumptions, suggesting that demand for its chips could face unexpected headwinds.

Adding to the uncertainty is the potential for heightened regulatory scrutiny. U.S. officials are poised to respond to China’s advancements with their own set of restrictions on AI chip exports, exacerbating challenges for Nvidia. Currently, Nvidia is barred from selling its top-tier chips to China and produces modified versions specifically for that market, complicating its competitive landscape further.

In addition to regulatory headwinds, technological competition is intensifying as alternative AI systems gain traction. Investors will be eager to hear how Nvidia’s latest AI chip, Blackwell, is faring in light of reports indicating that its rollout has faced significant delays due to heating and yield issues. Understanding the implications of these challenges will be vital for gauging Nvidia’s future in the competitive AI marketplace.

The outlook for infrastructure spending remains a critical factor in Nvidia’s continued success. While analysts from Morgan Stanley have painted a mixed picture regarding major clients like Microsoft potentially scaling back their capital expenditures, Microsoft itself has countered these claims, affirming its commitment to investing a staggering $80 billion in infrastructure in 2025. Similarly, other major players like Alphabet, Meta, and Amazon are also ramping up their spending commitments, indicating that demand for AI infrastructure is far from waning—as long as the relationships between Nvidia and these companies hold strong.

The upcoming earnings call presents a crucial opportunity for Nvidia to reinforce investor confidence. As discussions evolve, signaling any ongoing strength in relationships with cloud companies, as well as providing a clear forecast for fiscal 2026, will be pivotal. Investors are not just looking for numbers; they are seeking assurance that Nvidia can navigate these swirling challenges while continuing to innovate and lead in a radically changing tech landscape.

As Nvidia steps into the financial spotlight once again, a mix of optimism and caution envelops investors. Analysts and stakeholders alike are poised to glean insights that could inform their perspectives on one of the industry’s most influential players. As the company grapples with regulatory pressures, technological competition, and shifts in corporate investment behavior, its capacity to sustain momentum amid these challenges will be both tested and closely observed. In a world increasingly driven by AI, how Nvidia responds to this moment could very well shape its future and that of the broader technology landscape.

Leave a Reply