Uber Technologies Inc. has recently made headlines after its fourth-quarter results were unveiled, leading to a mixed response in the market. While the company exceeded revenue expectations, the stock took a notable dip due to a cautious outlook for the future. In this article, we delve into the intricacies of Uber’s performance, examining both the highlights and the caveats that may impact investor sentiment moving forward.

Uber’s fourth-quarter results showcased a genuine growth trajectory, with revenue hitting $11.96 billion—surpassing analyst expectations of $11.77 billion. This represents a substantial year-over-year increase of 20% from $9.9 billion in the corresponding quarter of the previous year. However, it is crucial to contextualize this growth within the broader economic landscape. Increased consumer spending on mobility solutions is buoying ride-sharing services, but the competitive nature of the market could stymie further growth.

The earnings per share (EPS) of $3.21 significantly outperformed the projected 50 cents, which is an impressive metric for any public company. Furthermore, Uber’s net income saw astronomical growth, soaring to $6.9 billion compared to just $1.4 billion a year ago. It is worth noting that this net income figure is buoyed by a one-time tax valuation benefit of $6.4 billion along with an additional pre-tax gain of $556 million from equity investments. Thus, while the headline figures are encouraging, a prudent investor must consider the sustainability of such lucrative earnings, particularly given that they are influenced by non-recurring events.

Another significant element of Uber’s quarterly report is its gross bookings, which reached $44.2 billion, outperforming analysts’ expectations of $43.49 billion. This was driven by a robust performance in its two primary segments: Mobility and Delivery. The Mobility segment recorded gross bookings of $22.8 billion, while the Delivery side brought in $20.1 billion—both showcasing an 18% year-over-year increase.

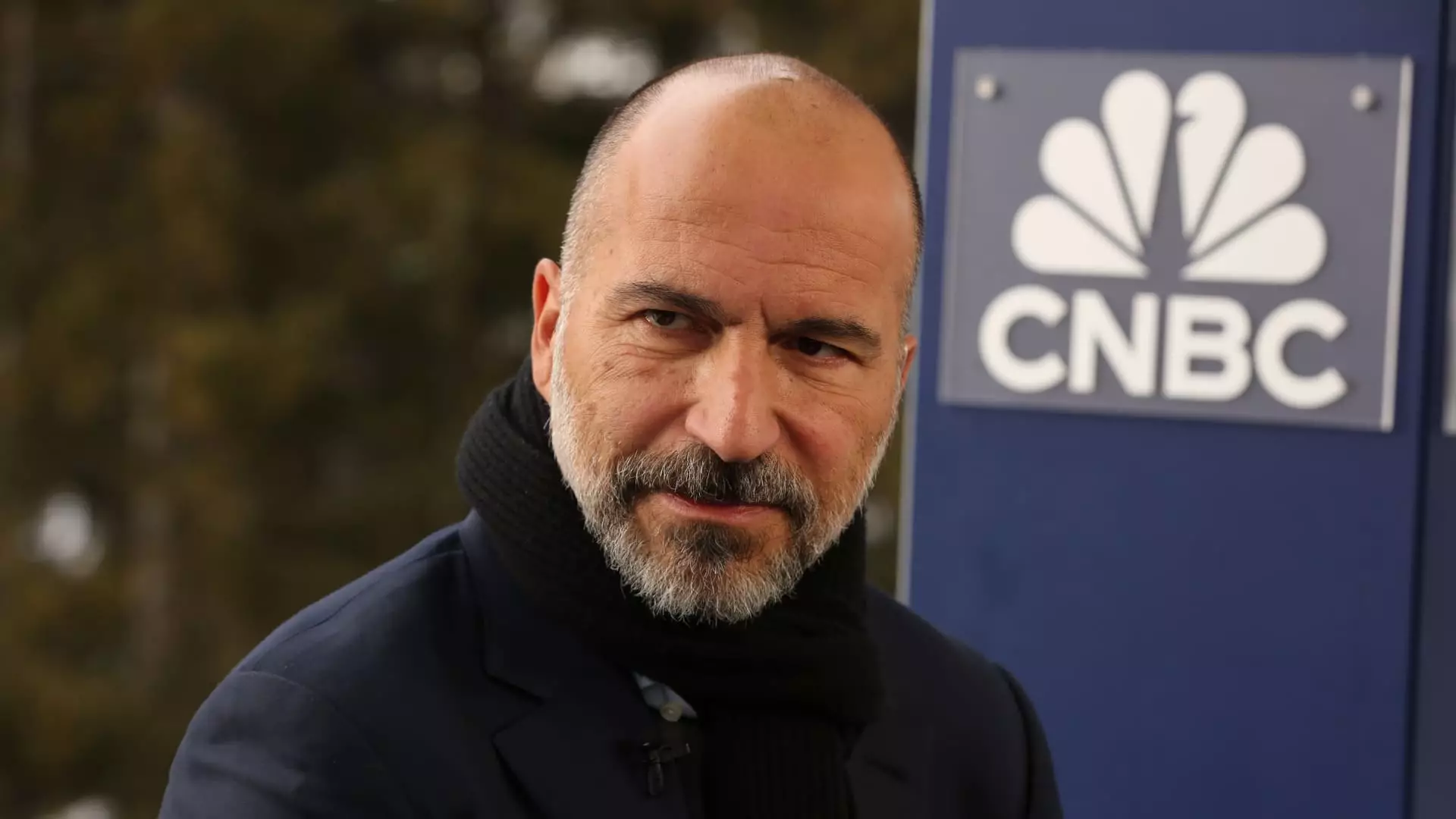

Uber’s ongoing innovation and adaptation to market demands have been highlighted by CEO Dara Khosrowshahi. In a statement, he emphasized the transformative potential of autonomous vehicles on the company’s operational strategies. As Uber gears up for the public launch of robotaxi rides in Austin in collaboration with Waymo, this development reflects a long-term ambition to streamline costs and increase profitability through automation.

However, the investor community’s enthusiasm was hindered by Uber’s cautious guidance for the first quarter of 2025. The company projects gross bookings to be in the range of $42 billion to $43.5 billion compared to StreetAccount estimates of $43.51 billion. Furthermore, its anticipated adjusted EBITDA for the same period falls slightly short of expectations, with projections between $1.79 billion and $1.89 billion against an expected $1.85 billion.

The market reacted adversely to this softer outlook, with shares declining by approximately 7% in premarket trading following the announcement. This kind of market response illustrates a growing tension between strong current performance and realistic future forecasts. Investors may be factoring in economic uncertainties and competitive pressures that could undermine Uber’s growth story.

Adding complexity to the situation is Uber’s freight business, which has faced difficulties post-pandemic as consumer preference shifts toward services rather than goods. The freight segment reported revenue consistent with last year’s figure, indicating stagnation in a segment that analysts had hoped would rebound. This necessitates a closer examination of Uber’s strategic pivots in its freight operations and overall service delivery to remain competitive.

While Uber has showcased outstanding performance in several areas, the uncertainty surrounding future guidance and the challenges within specific segments could leave investors grappling with mixed feelings. As they weigh current achievements against upcoming hurdles, the future trajectory for Uber will largely depend on its capacity to innovate and adapt in an evolving market. Continuous monitoring of both operational performance and market conditions will be essential for stakeholders looking to navigate the complexities in Uber’s growth narrative.

Leave a Reply