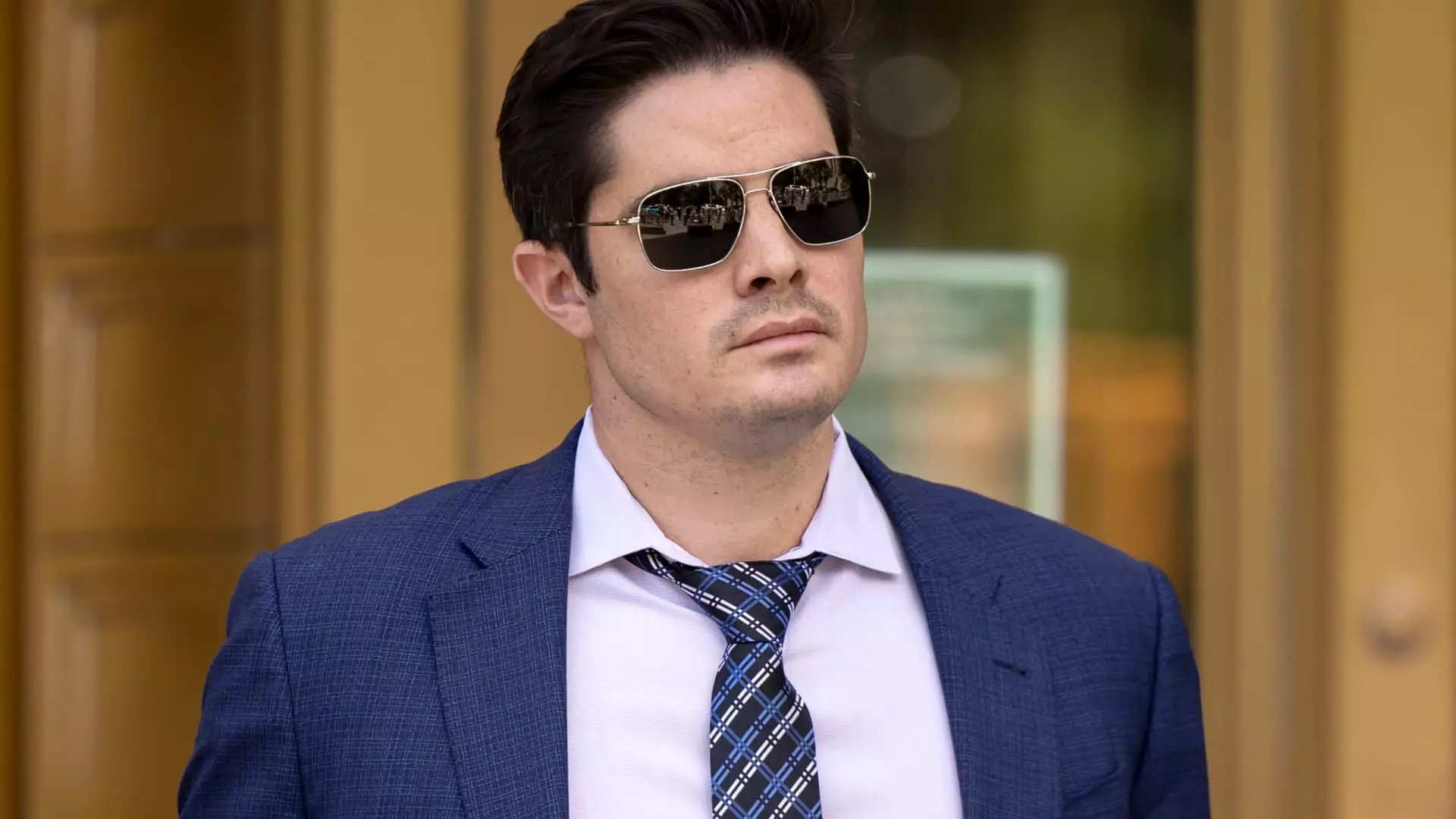

Ryan Salame, once a trusted confidante and top lieutenant of FTX founder Sam Bankman-Fried, has been handed a severe punishment by the legal system. A federal judge sentenced Salame to 90 months in prison, which amounts to seven and a half years behind bars. In addition to the lengthy prison term, Salame has also been ordered to serve three years of supervised release. Moreover, he faces a hefty financial burden, with more than $6 million in forfeiture and over $5 million in restitution to be paid.

The Sharp Contrast in Legal Recommendations

The sentence meted out to Ryan Salame far exceeds what was initially suggested by prosecutors. While the prosecution had recommended a term of five to seven years, the judge’s ruling of seven and a half years represents a considerably harsher outcome. On the other hand, Salame’s defense team had urged the court for a much milder sentence of just 18 months. The significant gap between the proposed and the actual sentence highlights the gravity of the offenses committed by Salame.

At one point, Ryan Salame occupied a position of high authority within Bankman-Fried’s crypto hedge fund, Alameda Research. However, his career took a different turn when he transitioned to become the co-CEO of FTX’s subsidiary, FTX Digital Markets, based in the Bahamas. During his tenure, Salame engaged in extravagant spending, investing heavily in real estate and making substantial contributions to political campaigns.

Serious allegations of unlawful activities surfaced against Salame, including conspiracy to make illicit political contributions and defraud the Federal Election Commission. Additionally, he was implicated in a scheme to operate an unlicensed money-transmitting business. The unraveling of these misdeeds led to a significant legal fallout, culminating in Salame’s guilty plea.

The Impact on Public Trust and Financial Integrity

The legal proceedings surrounding Ryan Salame’s case have cast a shadow over the realms of American elections and financial systems. U.S. attorney Damian Williams emphasized the detrimental effects of Salame’s actions on public faith in the electoral process and the integrity of financial institutions. The severity of Salame’s sentence serves as a stark reminder of the consequences that accompany such egregious offenses.

In a surprising turn of events, insiders within FTX, including Salame’s former colleagues and associates, provided testimony that bolstered the case against Sam Bankman-Fried. These individuals, such as Alameda’s former CEO, FTX co-founder, and other key figures, contributed crucial evidence that ultimately led to Bankman-Fried’s guilt in November. Salame’s decision not to testify during the trial marked a significant development in the legal proceedings.

Ryan Salame’s sentencing and the subsequent revelations of misconduct have unfolded as a cautionary tale of insider betrayal and the far-reaching implications of financial malpractice. The repercussions of Salame’s actions have reverberated through the spheres of American governance and financial propriety, underscoring the importance of upholding ethical standards in all aspects of public and private conduct.

Leave a Reply